Can’t-Miss Takeaways Of Info About How To Apply For A Small Business Loan

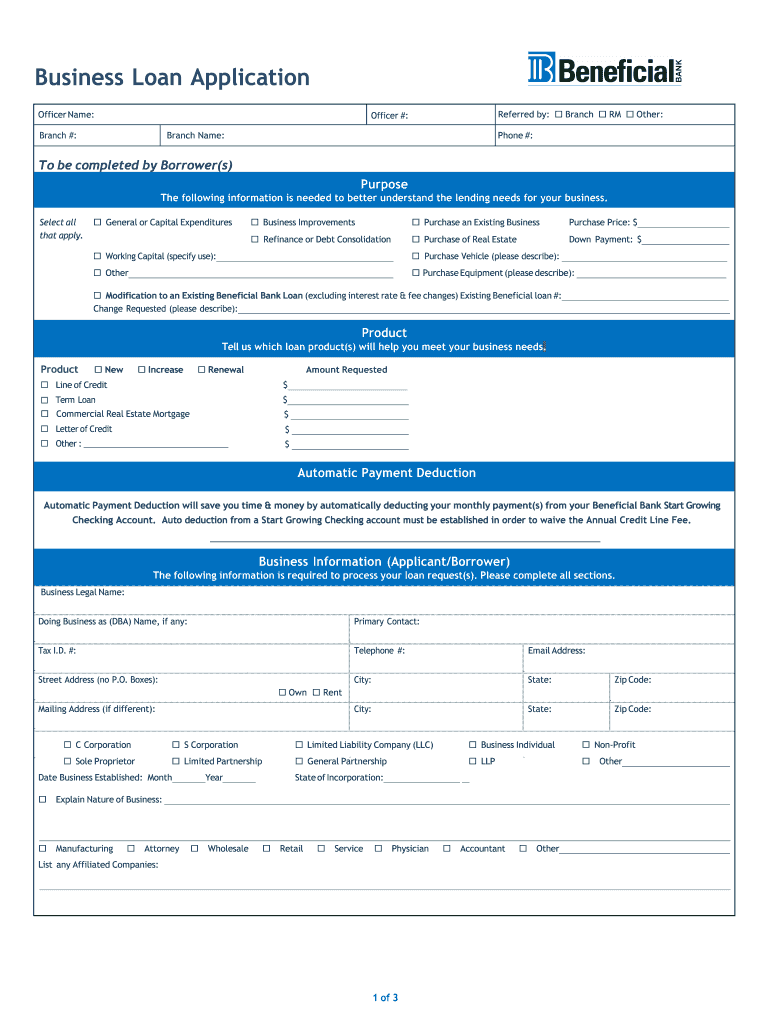

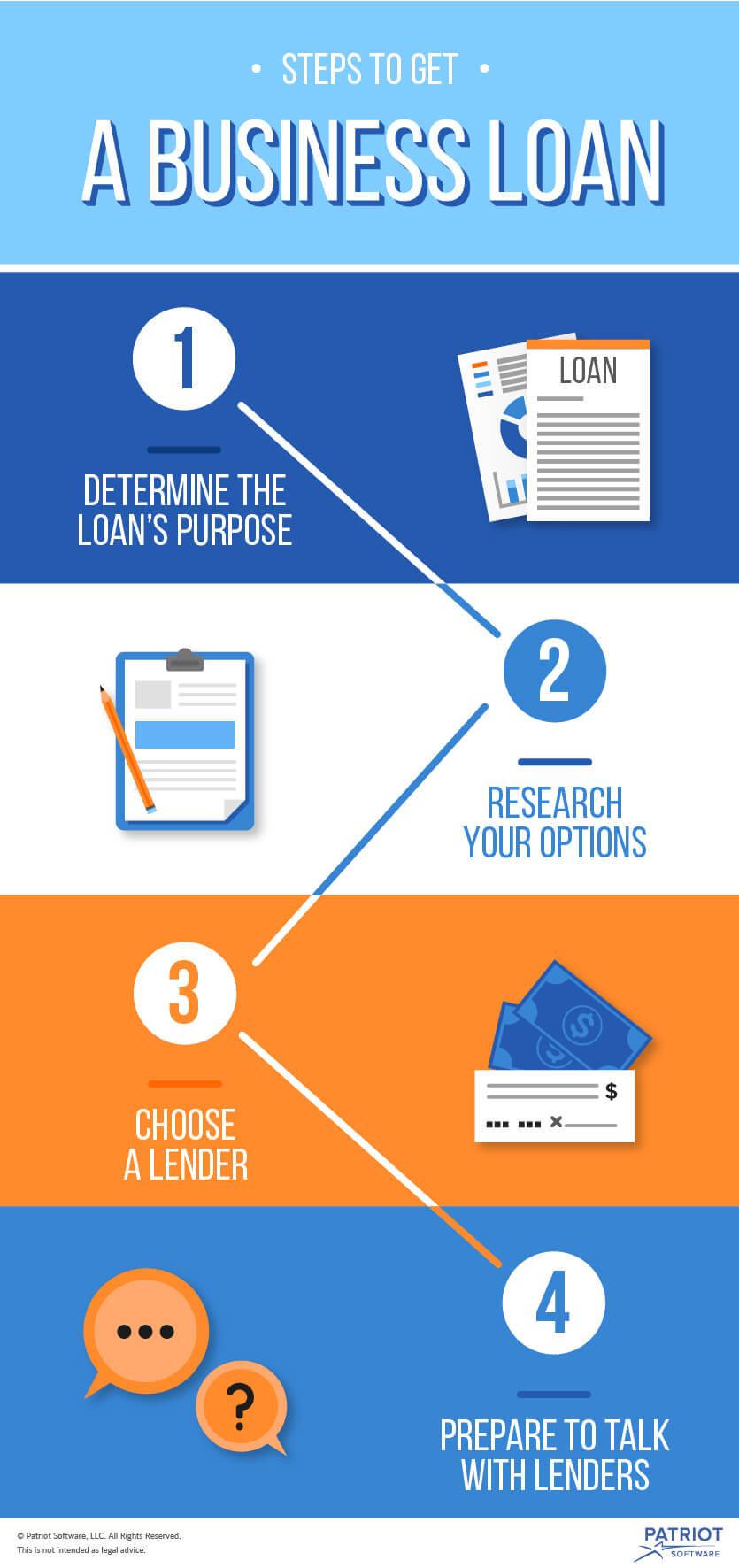

How to apply for a business loan.

How to apply for a small business loan. Get your free instant equipment loan estimate today!. Ad compare 2022's best small business loans. Use lender match to find lenders that offer loans for your business.

Offers 7 (a) loans to those businesses which have been affected by nafta, to assist employee stock ownership plans. Apply for licenses and permits; Bring along a business adviser or accountant who can help you.

Ad apply for funding, if approved, pay only for what you borrow. The business loan application process also differs. Microloans can be a great option as a startup loan for a small business, especially because they’re more accessible than traditional loans.

Paycheck protection program (ppp) the paycheck. The small business administration (sba) offers programs that can help your business if it’s been affected by the coronavirus pandemic. A small business administration (sba) loan is a type of business lending that is serviced by private lenders, but partially guaranteed by the federal government through the sba.

At the moment, the sba 7 loan program has a variable interest rate of 7.75% to 10.25%, depending on the loan amount and repayment period. Know your personal and business credit: Now that you understand the different types of business loans, here’s how to apply for one:

Equip your business with the tools and machinery it needs to get work done. Ad up to $250k in 24 hours for all levels of credit based on cash flow. Easier and faster than any bank loan!

/GettyImages-168450140-57a260d65f9b589aa937eef5.jpg)